One of the most exciting and difficult periods for a startup company is when it raises startup money. To help their company grow, the founder looks for investors, loans, grants, and other sources of finance. If the firm is successful, it will have the money to keep developing its products or offering clients additional services. If not, the business might have to permanently close its doors. Click to watch a video version of this post.

Click here to Access free resources for your business plan.

Finance for startups can be complicated. In addition to using founder funds to bootstrap a startup, many early-stage enterprises obtain funding from a number of sources. It’s crucial to know how to secure early investment. Startups fail in 30% of cases because of wrong types of financing.

A startup must go through several funding rounds to show that the business is deserving of the investment while overcoming various obstacles each time. Each round, which may last up to a year, aims to generate enough money for the company to expand. However, a lot of business owners cram everything into a 6 or even 3 month timetable.

The Following Stages Are Used to Categorize Startup Fundraising Rounds According to Their Purpose:

pre-seed/seed;

series A, B, & C;

and IPO.

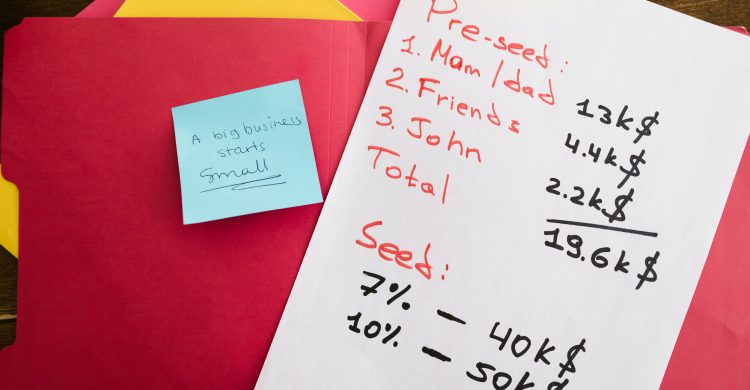

Pre-seed funding refers to the stage when founders struggle to give their idea the first boost and frequently invest their own money. Pre-seed is the initial phase of financing a business, and an investment is received from the founder’s personal resources, family, friends, backers, or network of other entrepreneurs. Years may pass during this stage as a corporation creates its foundation. Or, if a business can establish itself, it might proceed fairly swiftly.

Bootstrapping is also a method of starting a company from ground without or with very little exterior funding. It is a method of funding small enterprises that avoids sharing equity or taking out big bank loans by having the owner pay for and use the resources themselves.

Crowdfunding also has evolved into a popular method of raising money. In contrast to a conventional business strategy, here customers “pre-order” your goods before you’ve even begun to create it. After that, you make the actual product with the funds you raised. On sites like Kickstarter or Indiegogo, a multitude of little investments from different people might serve as a solid foundation for your firm. All you have to do is persuade them using your business plan, a prototype, or a video in which you outline your objectives, schedule, and milestones.

Seed funding: The first official funding a firm receives is called seed funding, and it frequently comes with equity. A portion of a startup’s equity is given up in exchange for quick cash. This funding round helps a business in funding its primary activities, such as product research, product launch, marketing to a target market, and audience development

Depending on their demands and presentation, tech businesses at the seed stage can hope for funding ranging from $500k to $2M. Investors are open to take risks and frequently fund several firms. Those who succeed are subsequently given more money.

Family, close friends, startup accelerators, incubators, angel investors, can all provide seed money. However, the sums raised vary greatly; some businesses raise $10,000, while others raise $2 million. A seed round typically values businesses between $3 million and $6 million.

Let’s have a look at seed founders like accelerators, incubators and angel investors:

Accelerators: Startup accelerators typically focus on providing startups with mentorship, advice, and resources to help them succeed, such as a Demo Day. A startup accelerator program accelerates the growth of existing businesses with a proven business model and market-tested products.

Startup accelerators give businesses access to essential tools including mentorship, free coworking spaces, legal services to protect intellectual property, a collaborative work environment, and connections to influential people in the industry and potential investors.

Incubators: A business incubator helps startups in their early stages become more profitable and successful. Startups can benefit from incubators’ valuable resources, which include free office space, tools, mentorship, a supportive community, and networking opportunities with possible investors including venture capitalists and angel investors. Business incubators concentrate on start-up companies that are still working on their business models and product ideas.

Universities, non-profits, for-profit development corporations, government-run economic development groups, and venture capital firms are some examples of the businesses and organizations that fund startup incubator programs. Startups submit an application to a business incubator, which often entails completing the incubator’s requirements and supplying a viable business plan.

Main differences between incubators and accelerators are:

Incubators concentrate on early-stage startups that are still developing their products and do not yet have a developed business model. Accelerators concentrate on fostering the expansion of businesses that already have a minimum viable product.

Usually incubators do not put money into startups, but they may request some equity in return for the important resources they are supplying. Accelerators frequently provide businesses a seed investment in exchange for an equity part in the business.

At business incubators, venture development frequently happens more slowly. Their goal is to develop a business idea for as long as it takes to build a successful company, which could be one to two years. Accelerators, on the other hand, frequently endure just three to six months and work more like startup boot camps.

So, how to decide whether to apply to an incubator or an acceleretor?

Your product and business model development stage:

Incubators are frequently the best options for start-up companies that do not yet have a developed product or a viable business model. Early-stage businesses with an existing minimum viable product (MVP) should use accelerators.

Your financial requirements:

Businesses that are not yet prepared to seek capital investment should consider incubators. Accelerators assist companies searching for a seed investment to help them grow.

Timetable:

While accelerators work with startups to scale up quickly within a few months, incubators support businesses over a longer period of time.

Angel Investors

An angel investor, also named as a business angel, is a high net worth individual who contributes money to the start-up, typically in exchange for equity.

Angels invest their own funds, in contrast to venture capitalists. Additionally, they finance many smaller, newer businesses.

Startup founders gain from the knowledge and capital provided by angel investors, but in exchange they must give up some ownership and managerial control.

Angel investors are accredited investors. According to SEC definiton and rules, an angel investor must have over $1 million in net worth, excluding primary residence (individually or with spouse or partner) and having earned more than $200,000 (individually) or $300,000 (with a spouse or partner) in each of the two years prior and expecting this level of income to continue in the current year.

Pros of working with angel investors can be

Being dept-free:

Entrepreneurs are not responsible for making any repayments because they are not required to take out loans. That will be especially useful if business suffers.

Expertise:

Angel investors with a lot of business expertise are sought after by astute business owners. Investors who have built successful businesses themselves are especially helpful.

Reduced paperwork:

A number of filing requirements with the SEC and state securities regulators are waived for businesses that raise capital from angel investors.

Later on, more Money:

After making an investment, angel investors are likely to make another investment in a subsequent round of financing.

Disadvantage of working with angels

Can be the fact that angel investors often demand 10% to 50% of your business in exchange for capital. This means that if the angel investors decide the business owners are preventing the company from succeeding, they could lose control of their company. It’s critical to consider how much equity you want to provide an investor in exchange for money because if you give too much, if things don’t work out, the angel investor may end up owning more of the firm than you do.

Series A

A company’s first substantial round of venture capital financing is often referred to as series A round (also known as series A financing or series A investment).

Venture capital firms make up the majority of the series A round’s investors. They are typically corporations that concentrate on making investments in early-stage startups. Venture capital firms, in general provide investment to companies that are already making money but are still in the pre-profit phase. Also angel investors and crowdfunding are some possible funding sources for Series A.

Series A finance, in contrast to seed rounds, has a wholly formal methodology. The majority of the investors in this round of financing are venture capitalists, and they will go through the due diligence and valuation process before deciding whether or not to invest.

A startup’s valuation is a crucial component of series A financing. Companies seeking series A money, as opposed to startups in the seed stage, are able to present more information that may be utilized to make knowledgeable investment decisions.

Series A is a method of financing that uses equity. This means that a business obtains the necessary funding from investors by selling its stock. But generally speaking, anti-dilution clauses are included in financings. Startups typically offer the investors, preferred shares without voting rights.

In many cases, convertible preferred shares are issued by the startups. At a certain future period, investors have the option to convert their preferred shares into common stock.

Less than 10% of businesses that raise a seed round go on to successfully raise a Series A round of funding.

Average Series A Funding in the US: The average Series A funding round in the US closed 2021 at $22.2 million, increasing from $15.6 million in 2020, a 30% boost. The average Series A investment for 2022 is $23.1 million.

The average round size and the quantity of Series A agreements both went up in the United States in 2021. In the United States, there were about 880 Series A deals in 2021, up 35% from the 650 Series A deals in the country in 2020.

Series B

Following Series A financing, Series B funding is the following phase of corporate financing. It is the third round in financing of a strartup. The business is now somewhat stable, its operations are efficient, and its market share is expanding. Although revenues are increasing, they might not be sufficient to dominate the market.

Series B financing round means that the company has developed its business and has led to a higher valuation.

Private equity investors, previous investors, existing investors, venture capitalists and credit investments are all potential sources of Series B funding.

The average Series B financing for a U.S. company in 2021 totaled $45 million, up around 50% from 2020. Additionally, the round size has increased even more so far in 2022.

Series C

Series C funding is the fourth round in funding stages. A Series C funding round typically takes place to support an IPO or to help the firm become more appealing for acquisition. The first of “later-stage” investments is this one. This may carry over into Series D, Series E, Series F, Series G, private equity fundraising rounds, etc.Companies that enter this round of funding have a high valuation and already have evidence of their performance. Companies that receive Series C funding are doing well and ready to expand into new markets, acquire competing businesses, or develop new products.

Late-stage VCs, private equity firms, hedge funds, and banks are some of the most popular Series C capital investors.

Companies typically raise an average of $50 million for their Series C round. Although it is conceivable for companies to be valued much more, especially with the rising up of “unicorns”, the valuation of Series C companies typically ranges between $70million and $120 million.

I.P.O (Initial Public Offering)

An initial public offering (IPO) is the procedure of releasing new shares to the public for the first time in a private firm. A corporation can raise equity funding from the general public through an IPO.

An organization is regarded as private before an IPO. The company has expanded with a small number of owners as a pre-IPO private company, including early investors like the founders, family, and friends as well as qualified investors like venture capitalists or angel investors.

Participating in an IPO is a big step for a company because it creates the opportunity for significant capital raising.. As a result, the company’s potential for expansion and growth is increased. Additionally, the improved transparency and reliability of the share listing may allow it to negotiate better conditions when applying for loans. When a business believes it has reached a stage in its development where it is ready for the requirements of SEC legislation as well as the benefits and obligations to public shareholders, it will begin to publicly announce its interest in going public.

Summary

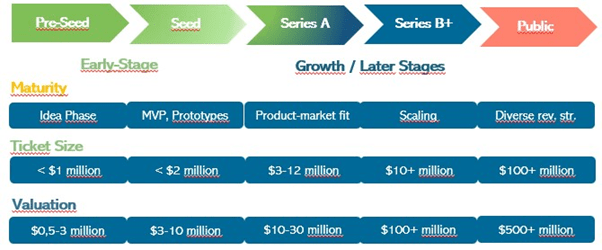

To summarize, let’s have a general look at the funding stages in a table:

Funding rounds explained

Early stages can be summarized as pre seed and seed stages. In these stages, idea is developed, idea validation is done, minimum viable product or a prototype is developed.

As the company proceeds, growth stages and rounds begin. These are series a and series b. In these stages, company realizes product market fit, owns a market share and scales.

Visit us at: www.peakplans.co and Schedule a free consultation for a fast and expert delivery of your business plan.